Finance and Accounting Outsourcing Offers Relief to Small Businesses in Connecticut Amid Rising Costs

Finance and Accounting Outsourcing Gains Popularity Among Connecticut Small Businesses Amid Cost Increases.

Simplify Your Financial Operations – Explore Outsourcing Solutions Today! Click Here

The global FAO market is experiencing rapid growth, expected to rise from USD 66.8 billion in 2024 to USD 110.68 billion by 2033, at a compound annual growth rate (CAGR) of 5.77%. This trend reflects a broader shift toward relying on external expertise to navigate complex financial landscapes. In Connecticut, where business costs are among the highest in the country, outsourcing finance and accounting functions provides much-needed relief, allowing businesses to access specialized skills and reduce operational expenses.

Ajay Mehta, CEO of IBN Technologies, emphasized, “Outsourcing finance and accounting isn’t just about reducing costs. It’s about providing businesses with the financial intelligence and flexibility they need to thrive. Partnering with experts improves financial oversight, ensures regulatory compliance, and supports sustainable growth.”

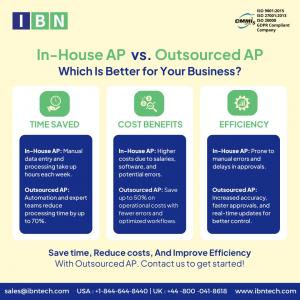

Connecticut businesses are increasingly recognizing the value of outsourcing beyond just cost savings. With the rising complexity of financial reporting and compliance regulations, many small businesses struggle to meet these demands with in-house staff. Outsourcing allows companies to mitigate financial risks, optimize cash flow, and respond to economic shifts without the constraints of full-time, in-house financial teams.

Advancements in technology have played a crucial role in the growing popularity of outsourcing. Cloud-based financial platforms now enable businesses to automate key functions such as bookkeeping, payroll, and tax preparation, providing accurate, real-time insights. As digital transformation accelerates, finance and accounting outsourcing are becoming essential tools for businesses aiming to enhance resilience and agility.

In addition to cost savings, outsourcing allows businesses to redirect internal resources toward strategic objectives, fostering long-term growth. In Connecticut’s dynamic business environment, companies that leverage outsourced financial expertise are better equipped to make data-driven decisions that drive expansion while maintaining financial stability.

Gain Full Financial Insight – Reserve Your Free Consultation Now!

https://www.ibntech.com/free-consultation/?pr=EIN

The state’s economic climate demands that businesses make informed financial decisions to stay competitive. Outsourcing finance and accounting services is proving to be an effective solution for Connecticut companies grappling with rising costs and strict regulatory requirements. By leveraging the expertise of outsourcing specialists, businesses can strengthen financial stability, improve operational efficiency, and position themselves for future success.

This shift toward outsourcing not only helps small businesses stay competitive but also provides them with the flexibility to focus on their core functions. By working with finance and accounting experts, Connecticut businesses can manage costs, comply with regulations, and scale successfully in a challenging economic landscape. As more companies adopt outsourcing strategies, the financial services industry in Connecticut will continue to evolve, offering businesses a clear path to long-term success.

Maximize Your Financial Strategy – Get Your Personalized Pricing Today!

https://www.ibntech.com/pricing/?pr=EIN

IBN Technologies remains a trusted partner for small businesses in Connecticut seeking tailored financial outsourcing solutions. With customized services, businesses can manage their finances with confidence, focus on innovation, and navigate the challenges of today’s economic environment. As the demand for outsourced financial services grows, Connecticut businesses have an opportunity to optimize their financial performance and drive sustainable growth in a rapidly changing market.

Related services:

Catch-up Bookkeeping/Year End Bookkeeping Services

https://www.ibntech.com/ebook/catch-up-bookkeeping-guide-for-financial-and-tax-success/?pr=EIN

Tax Preparation and Support

https://ibntech.com/us-uk-tax-preparation-services/?pr=EIN

Bookkeeping Services USA

https://www.ibntech.com/bookkeeping-services-usa/?pr=EIN

Payroll Processing

https://www.ibntech.com/payroll-processing/?pr=EIN

About IBN Technologies

IBN Technologies LLC, an outsourcing specialist with 25 years of experience, serves clients across the United States, United Kingdom, Middle East, and India. Renowned for its expertise in RPA, Intelligent process automation includes AP Automation services like P2P, Q2C, and Record-to-Report. IBN Technologies provides solutions compliant with ISO 9001:2015, 27001:2022, CMMI-5, and GDPR standards. The company has established itself as a leading provider of IT, KPO, and BPO outsourcing services in finance and accounting, including CPAs, hedge funds, alternative investments, banking, travel, human resources, and retail industries. It offers customized solutions that drive efficiency and growth.

Pradip

IBN Technologies LLC

+1 844-644-8440

sales@ibntech.com

Visit us on social media:

Facebook

X

LinkedIn

Instagram

YouTube

Distribution channels: Business & Economy

Legal Disclaimer:

EIN Presswire provides this news content "as is" without warranty of any kind. We do not accept any responsibility or liability for the accuracy, content, images, videos, licenses, completeness, legality, or reliability of the information contained in this article. If you have any complaints or copyright issues related to this article, kindly contact the author above.

Submit your press release